Office Bullsh*t

If you want your company to succeed the best thing you can do is care about the truth

Why do companies exist? People have formed associations, guilds, partnerships, unions and all kinds of corporate structures to conduct their business forever but it is not obvious why1.

In 1937 Ronald Coase investigated this question in a paper called "The Nature of the Firm". His answer was that companies reduce the cost of finding the optimal structure to produce goods. The chain of reasoning goes like this:

In general our transactions are governed by the "Price Mechanism". There is a supply and demand for every good. The invisible hand operating over all potential transactions leads to an acceptable price so that exchange can happen.

The problem is that the price mechanism is not free. It takes time and energy to find potential buyers and sellers, negotiate contracts, handle disputes etc.

This is why companies were necessary. A company can organise the structure of its internal elements to create a good more cheaply than if it resorted to the price mechanism. In particular you can see how this operates for employees. The employer-employee relationship allows all the contract costs for the individuals involved in making the good to be simplified into a single set of employment agreements. These document can govern a vast range of activities without resorting to the constant information gathering and negotiation that would be needed if you required a fresh contract for each piece of work. As Coase puts it:

[We may say that] the operation of a market costs something and by forming an organisation and allowing some authority (an " entrepreneur ") to direct the resources, certain marketing costs are saved. The entrepreneur has to carry out his function at less cost, taking into account the fact that he may get factors of production at a lower price than the market transactions which he supersedes, because it is always possible to revert to the open market if he fails to do this.

In other words, companies exist to the degree that they can outcompete the "price mechanism" and the "open market" for the cost of producing certain goods. But, if this is the case it immediately raises another question: If a company is so good at directing its internal resources to outcompete the price mechanism why is everything not managed by one giant company?

Coase explores a few answers to this question. He lands on the idea that it is the result of a kind of mismanagement. A company will grow to the degree that it is able to accurately understand the best way to organise resources i.e. the degree to which it can identify reality and interact with it appropriately. As long as a company can continue to do this cheaply it will outcompete the price mechanism2. So, companies will grow up to the point that the costs of their distorted view of reality equals the costs of using the price mechanism to determine the next best alternative.

Companies detach from reality all the time. In part it happens simply due to plain incompetence: bad ideas about how to organise people, bad research leading to poor decisions about new products to launch etc. However, there is also a moral dimension. The people working in the company move away from the truth.

It is not that people lie. We know what lies look like and the vast majority of sensible people avoid them. Enron and FTX though they are high-profile cases are definitely outliers, not the norm, for corporate governance. Instead of lies companies get filled up with bullshit.

Bullshit3 is different to lying. A liar knows what the truth is and actively attempts to subvert it to achieve some end. A bullshit artist doesn't attempt to mislead about the truth they just don't care what the truth is.

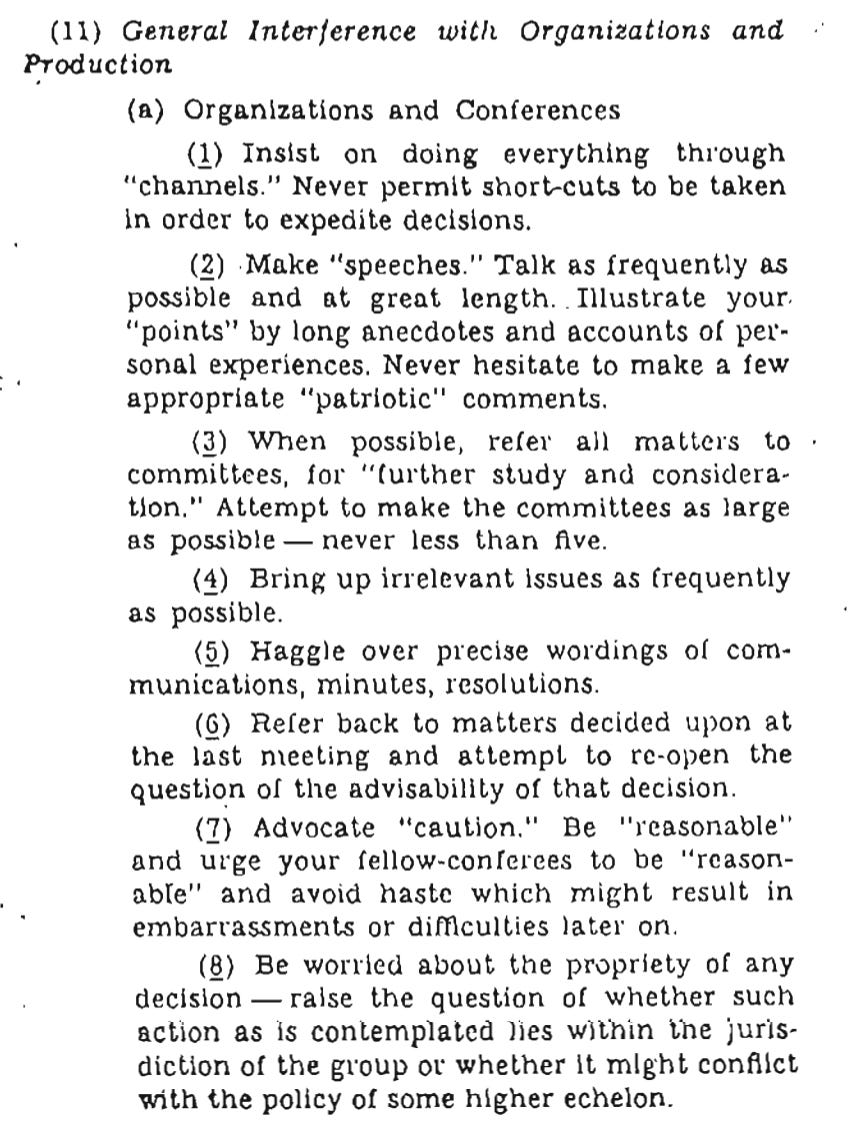

Bullshit accrues in the weekly review meetings that discuss the same ‘action items’ without ever seeing progress, in the failure to communicate relevant information until a point that is just a little too late, and most of all in the corporate slogans and company values that have less than zero relation to how people actually work day-to-day.

Every piece of bullshit like this that enters a company erodes its relative competitiveness at organising production compared to the price mechanism. In other words, it eats up a company's extra capacity. For roughly similar companies in similar industries you might poetically even say that their operating margin is a measure of how much bullshit has crept in. The larger the margin the less bullshit. As a corollary the more valuable a company's core product the more room there is for bullshit to creep in. Sometimes there's a ton of money sloshing around but the people at the firm just don't know what to do with it.

Caring about the truth and then putting your back into working in relationship to it is hard. It’s painful to try and then even more painful when it leads to mistakes, and failure. To avoid this state the company, especially if they have a healthy underlying profit, can simply stop caring about the truth and let the bullshit fill the void.

Almost everyone who has worked in an office setting of nearly any size has a pretty good sense of how this works. It's why Dilbert comics and the Office are so relatable4. It seeps in from nowhere in particular and has a gravity that is hard to escape. But at least if we start to recognise it for what it is we can make progress.

Bullshit accumulates because of a lack of care for the truth. Maybe if we try in our own small ways to pay attention and give concern for the things that matter we can help our companies, and along with them our economies and our societies achieve much more.

Thanks to Casey Li for reading a draft of this essay

Links

The Psychological Impact of The Birth Control Pill

This podcast was wild. When I was done listening to it I felt like I might just have heard an alternative history of the last 100 years. In the conversation Sarah Hill discusses her research work and her new book This Is Your Brain on Birth Control. The bulk of the episode was spent explaining results that have been found about the psychological impact of birth control on women. To give a small example: women who take hormonal birth control during adolescence are three times as likely to experience depression. The overwhelming sense I came away with was similar to what I got from reading Seeing Like A State. In the 20th century we tried a number of major technocratic experiments to massively remake our society. Many of the outcomes of these experiments were undoubtedly good (I certainly can’t argue in any meaningful way that women taking control of their reproductive capabilities is bad). However, our narrative of these changes is purely positive. We believe they are all upside. The truth is we made a trade and we should know what that trade was.

The specifics of modern corporate structure is the result of a very particular journey that began with royal charters issued in the Netherlands and England in the 17th century, took a detour in New York in 1811, and is currently incorporated in the state of Delaware. But, this is only a small part of the story.

The price mechanism of course will by definition track reality perfectly but it will do so slowly and with a degree of error that the company can at some scale overcome.

If you haven’t read it I highly recommend the definitive philosophical take on Bullsh*t by Harry Frankfurt. It's a masterful essay and a great example of clear, concise beautiful philosophy.